Published by Wiktoria GRYCAN, Wroclaw University of Science and Technology, ORCID: 0000-0001-8121-7612

Abstract. Prosumerism is inherently designed to be a tool that alleviates the grid. Still, not every prosumer aligns the consumption profile with the energy generation profile in photovoltaic installations. Therefore, the rapid development of Renewable Energy Sources (RES) in Poland, especially photovoltaic installations, has changed the energy generation structure, altering the working conditions in the grid. This work aims to identify how the current legislative support affects the profitability of RES and to determine how they should be adjusted to encourage investment in the right groups of recipients from the point of view of the security of the energy network.

Streszczenie. Prosumeryzm jest z założenia narzędziem, mającym na celu odciążenie sieci energetycznej. Jednakże, nie każdy prosument dostosowuje swój profil zużycia do profilu wytwarzania energii w instalacjach fotowoltaicznych. Dlatego też, wzmożony rozwój Odnawialnych Źródeł Energii (OZE) w Polsce, zwłaszcza instalacji fotowoltaicznych, zmienił strukturę wytwarzania energii, co wpłynęło na warunki pracy sieci. Celem tej pracy jest zidentyfikowanie, w jaki sposób obecne wsparcie legislacyjne wpływa na opłacalność OZE i określenie, w jaki sposób należy je dostosować, aby energię wytwarzały właściwe, z punktu widzenia bezpieczeństwa sieci energetycznej, grupy odbioców. (Wsparcie legislacyjne dla energetyki prosumenckiej w ramach bezpieczeństwa elektrycznego sieci elektroenergetycznej)

Keywords: prosumers, energy consumption, dynamic tariffs, photovoltaics

Słowa kluczowe: prosumenci, zużycie energii, taryfy dynamiczne, fotowoltaika

Introduction

Due to the European Union’s ‘green energy goals,’ the number of photovoltaic installations in Poland has steadily increased. By January 2023, their installed capacity had reached 12.1 GW [1], 50% of the maximum power demand in the Polish energy system in 2022, which was 24.9 GW [2]. The installed capacity of solar panels has exceeded expectations and forecasts.

The 2030 goal, as outlined in ‘Poland’s Energy Policy until 2040,’ [3] aimed for a 32% share of all Renewable Energy Sources (RES) and at least 40% by 2040 in net electricity production by 2030. This goal has already been achieved thanks to incentives encouraging renewable energy installations. Numerous financial support programs [4], such as ‘Mój Prąd,’ ‘Czyste Powietrze,’ ‘Stop Smog,’ ‘Agroenergia’ for households, and ‘Energia Plus,’ ‘Przemysł energochłonny OZE,’ ‘Gwarancja Biznesmax,’ for businesses, have played a key role. These incentives, especially for households, typically take the form of grants, covering up to 50% of the investment costs, which has led to a significant growth of photovoltaics among this group.

In the existing low-voltage networks, the power flow has traditionally been unidirectional. Consequently, the grid and its protections were designed to ensure consumers a reliable power supply. Still, the evolving energy generation landscape is changing the working conditions, which has, due to the delayed grid modernization, caused various challenges. As reported by Kacejko and others [5], these challenges include exceeding quality thresholds for energy, such as higher harmonics, voltage fluctuations, and flicker indices. There have also been cases of surpassing permissible current values in power lines and transformers, exceeding voltage limits at network nodes, uncontrolled operation of micro installations during islanding, and improper functioning of protective devices.

Among these issues, the most significant problem highlighted by Kacejko and others [5] is the risk of voltage surges. This problem has been increasingly noticed in scientific publications [6,7] and by users of such installations [8]. The disconnecting of installations during voltage spikes [8] has made the issue particularly significant from a prosumer’s perspective, leading to numerous complaints [9].

In response to these issues, efforts are focused on the network’s operation and ensuring proper working conditions and safety. Various measures are being explored to maximize effectiveness while minimizing investment costs [5]. Rafał, Bielecki, and Skoczkowski [10], for instance, propose dynamic voltage regulation in the distribution network using inverters. At the same time, Cieślik suggests using power storage in stations for active power regulation [11]. Nevertheless, solving these issues at a national scale will require time and substantial investments.

In addition to local voltage surge problems, there is an increasing issue of energy overproduction in the network during peak sunlight hours [12,13]. Olczak and others [14] have highlighted the need to balance demand with temporary overproduction during maximum sunlight hours.

Prosumers should focus on selecting the installation capacity according to actual demand and adjusting their consumption to the generation profile. This adjustment can be achieved through individual energy management, such as load shifting over time using smart devices or energy storage instead of returning excess energy to the grid. Households do not widely adopt these actions, as they involve inconveniences, the need to modify habits, or significant additional financial costs.

Significant legislative changes resulting from the need to improve the operational security of the power grid are included in [15]. Document from December 2022 [15] has changed from a quantitative to a financial system for settling energy supplied to the grid to encourage prosumers to align their consumption with energy generation. Since next year (June 1, 2024), future changes may eventually allow energy settlement based on hourly rates (Chapter 2 Art. 4b.2 [16]), which would better reflect actual energy demand in the grid. Presently, it is the average monthly price for electricity generated from a renewable energy source and introduced into the electricity distribution network from July 1, 2022, to June 30, 2024 (Chapter 2 Art. 4b.1 [16]). Also, introducing the concept of a collective prosumer in the law [15] supports individual consumers who generate energy where it can be consumed at the time of generation. It encourages energy generation in multi-apartment buildings located in urban areas with significant energy demand.

This study aims to analyze how current and future legislative support impacts the profitability of RES in various consumer groups and how it can be further tailored to incentivize the right groups, considering the energy grid’s stability and safety.

Methodology

To estimate the generated energy, a tool available on the European Commission website, “Photovoltaic Geographical Information System,” was used [17]. Then, the consumption profiles of three companies were used. One location was adopted for all objects. In the enterprise analysis, generation from a 50kWp micro installation located in south-eastern Poland was first calculated. Company A is characterized by stable energy demand during the day and throughout the year (Fig. 1). Its demand is approximately 630 MWh/year. The energy demand for company B is approximately 100MWh/year. The highest demand occurs on working days between 6 a.m. and 4 p.m. (with a break at 11 a.m.). On weekends, demand drops by approximately 30% (Fig. 1). Company C consumes around 400 MWh/year annually. It works 24 hours daily, with the highest energy consumption between 8 a.m. and 10 p.m. (Fig. 1). Data on generation and consumption were compared, the amount of energy sent into the network was estimated, and the payback period was calculated, considering various types of support.

Co-financing for renewable sources in the case of enterprises usually includes lower-interest loans or loan certificates. The most popular in 2023 include:

– Energy plus – for the reconstruction and connection of RES installations (loan up to 85% of eligible costs: from PLN 0.5 million to PLN 500 million, [18]

– Energy-intensive RES industry [19] – construction or reconstruction of a RES installation, along with connection to the power grid or plant, or with an energy storage facility (loan, up to 100% of eligible costs, in the amount from PLN 5 to 300 million, possibility of receiving a bonus of up to 30% of the amount paid, the need to use at least 80% of the energy generated for own needs),

– recruitment ended on May 10, 2023, therefore the tool was not taken into account in the analysis.

– FENG ecological loan – a subsidy of 20-70% for the repayment of the capital part of the loan – ELENA grant (modernization must reduce energy consumption by at least 30%) [20],

– White certificates

– construction of renewable energy installations and other pro-efficiency activities (possibility of selling the acquired certificate, subsidy depending on the current price of the certificate and the amount of energy saved

– required minimum amount of 116.3 MWh=1toe; replacement fee in 2023 was PLN 2,010/1toe) [16]

– funds from the KPO

– consider the research aspect of modernization activities or are in the process of being agreed upon. Hence, they will not be analyzed in this work.

The prepared analysis included an ecological loan (40% of the capital part) and a white certificate as tools that financially support the entrepreneur. It was assumed that enterprises would cover the investment from their own funds. In the case of companies A and C, which consume all the energy produced, the saving is the cost of energy that did not have to be purchased. In the case of company B, financial settlement (net billing) was included (with and without using the dynamic price).

The investment cost was estimated at PLN 300,000, using offers from external companies. The energy purchase price was adopted in three variants: I-PLN 794/MWh (average price for the second quarter of 2023), II-PLN 1,500/MWh, and III-PLN 2,000/MWh. Distribution fees were averaged between companies. The price of resale of electricity to the network was adopted in three variants: fixed and equal to the purchase price, fixed and lower than the purchase price, variable monthly price [21] depending on the time of day and season, and dynamic price [21]. Due to the volatility of prices in the energy market, these amounts may be underestimated and overestimated, which is why various variants were considered.

Further considerations were also made for the household. A facility located in the same town as the analyzed enterprises was selected. The annual electricity consumption for the domestic user is 4.1 MWh. The nature of consumption varies (Fig. 2) depending on the season (higher consumption in summer) and the time of day (highest consumption between 3 p.m. and 10 p.m.).

The amount and character of consumption on weekdays and weekends are similar. Three installation cases were assumed for the farm (5 kWp, 3 kWp, and 10 kWp). 10 kWp variant was adopted to check if the oversizing of prosumer installations is beneficial, according to current settlements (12 months to collect the financial deposit in the form of the volume of purchased energy, and after that time, a 20% refund of funds, Chapter 2. Art. 10a section 2 [16]). Data on generation and consumption were compared, the amount of energy given into the network was estimated, and the payback period was calculated, considering various types of support. Because the household does not use the entire volume of energy at the time of its production, and as it was written in the introduction, this may be an unfavorable phenomenon from the network’s point of view, an installation variant extended with energy storage was also considered. Financing for renewable sources for households mainly includes compensation and subsidies. In addition to regional programs, the basic program supporting renewable energy in households is “My Electricity.”

In 2023, the program was significantly modified [21]. The legislator rewards all activities that are intended to encourage self-consumption. The basic subsidy for the installation itself is up to PLN 6,000. PLN, but additional funds can be obtained for a heat pump (up to PLN 28,000), energy storage (up to PLN 16,000), solar collectors (up to PLN 3.5 thousand), and even an energy management system (up to PLN 3,000)). The co-financing cannot exceed 50% of eligible costs. The article assumes a variant involving obtaining funds for installation and energy storage. It was implicit that the maximum possible funding would be received. The installation cost and subsidy amounts were based on average offers from external entities, as in Tab. 1.

Table 1. The investment cost and founding amount used in calculations

The energy purchase cost was calculated assuming the current average price per MWh (including distribution), i.e., PLN 1000/MWh as variant I and PLN 1500/MWh as variant II. The energy sales price was adopted the same way as in the case of enterprises. It was decided to calculate a simple payback period. Yet, it would be advisable to consider the discount rate in the analyzed periods. The payback period is not the subject of consideration but only its comparison between individual variants. The time factor was not considered due to its dynamic nature and difficulty estimating changes over the last year.

Analysis

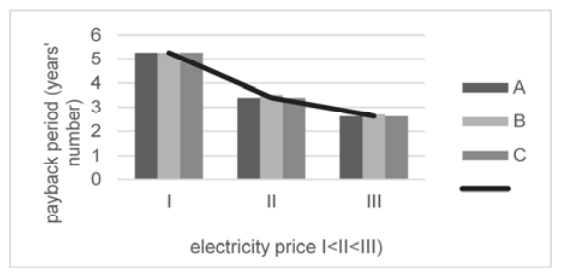

In the case of enterprises, the investment payback period is most influenced by the purchase price of electricity (Fig.3). This is also why, in 2022, companies were particularly interested in investing in renewable energy. As this price increases, the payback period decreases. For a price of PLN 2,000 (price level from the third quarter of 2022), the payback period is shortened to 2.5 years. The lowest price was PLN 794/MWh. For a lower price, the payback period would be extended.

When the sale price varies (dynamic prices), depending on the hour of the day and the season, the payback period is extended, although slightly (12%, i.e., eight months), because the company consumes 70% of the energy it produces.

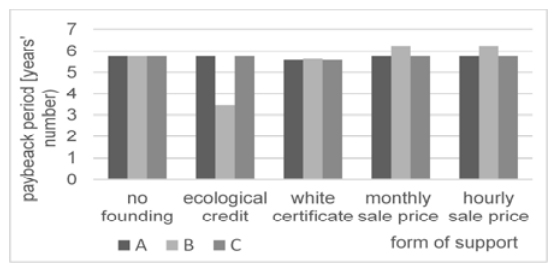

Obtaining a white certificate with an investment of 50 kWp does not significantly impact the payback period (Fig. 4), regardless of the analyzed company. The most significant support is a grant to repay part of the capital under the FENG measure and the Elena grant (ecological loan). However, the modernization must bring at least 30% energy savings, so only company B could benefit from it. Depending on the funding obtained, the payback period decreases proportionally.

Companies, as prosumers, can use most of the energy produced by their installations. Therefore, the payback period of the investment is not influenced by the price of resale of energy to the grid. Due to the significant volume of energy consumed, they depend mainly on the purchase price. For enterprises, the payback period is most significantly influenced by subsidies for installations, which constitute the best incentive next to rising energy prices.

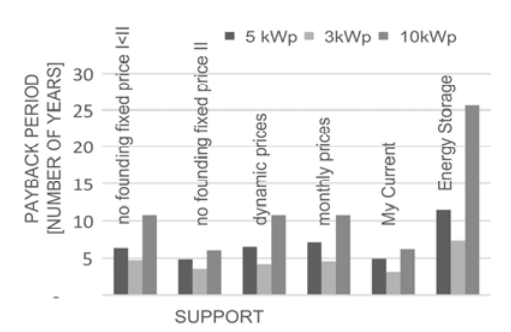

In the case of households and enterprises, the investment payback period (without additional stimulating factors) is similar. However, households often do not consume energy (unlike businesses) while producing it in a photovoltaic installation. This makes them much more sensitive to changes in energy prices and financial support mechanisms. An increase in the energy purchase price shortens the return on investment by approximately 30%. It is a regulated price until the first quarter of 2024, but it may rise even 100%. In the case of households, switching to net billing does not have a significant impact on the payback period of the investment (it extends it by a few months – Fig. 5). Still, as prices fall in situations of expected overproduction in future years, this system can significantly extend the payback period. The calculations used data from 2022, which were historically high. Households resell a small energy volume, and prices vary by about 30% between resale hours. It is difficult to predict how prices will develop, especially considering hourly price levels.

The settlement mechanism intended to prevent over-dimensioning of the installation works appropriately (Fig. 5). Each analyzed variant’s payback period for a 10 kWp installation is significantly longer. From the point of view of proper network operation, additional subsidies for energy storage installations are an essential supporting measure. Unfortunately, despite increasing funds for this purpose, an installation with storage still has a more extended payback period than an installation without it. The payback period is extended by at least one year. For prosumers’ motivation to make such investments, the opportunity of funding should be increased, e.g., to 70% of the costs.

Conclusions

The analysis of the cases discussed in the article indicates the lack of equal support for photovoltaic installations in various groups of prosumers. Despite a similar payback period for installations without subsidies, households can count on more significant support than enterprises. Considering social policy and the financial capabilities of small entities such as households, we can understand the need for additional household support.

Yet, from a technical point of view, this action is unjustified. Its purpose is to ensure the safe and stable operation of the network. Often, companies have land that allows them to install renewable energy sources exactly where energy is consumed. The company’s investment in renewable energy sources not only does not generate the problem of power that is difficult to receive through the network but also reduces the company’s demand at the point of energy supply. Encouraging enterprises to make such investments seems justified, especially in making the subsidy dependent on the degree of use of the generated energy.

To sum up, more financial resources should be allocated to support enterprises investing in renewable energy sources. Additional programs should also be created to include subsidies and compensation in this group. At the same time, allocating more funds to support self-consumption in households seems justified. Shortening the payback period for installations with storage compared to installations that do not store energy would make it possible to popularize this type of solution. It is also worth considering making the subsidy amount dependent on the degree of use of the generated energy for one’s own needs.

To support entrepreneurs in building new renewable energy sources, it is also important to ensure stable regulations that enable investment planning over time. The introduced dynamic tariffs, although at current rates, do not significantly reduce the profitability of renewable energy – they are making predicting its profitability very difficult.

REFERENCES

[1] Ministry of Climate and Environment. Agencja Rynku Energii S.A., Statistical information on electricity. Monthly Bulletin, No.1(349), January 2023.

[2]PSE-https://www.pse.pl/obszary-dzialalnosci/krajowy-systemelektroenergetyczny/zapotrzebowanie-kse, accessed 25.07.2023.

[3] Ministry of Climate and Environment, Poland’s Energy Policy until 2040r., Warszawa 2021. https://www.gov.pl/web/klimat/polityka-energetyczna-polski, accessed 25.07.2023

[4]https://enerad.pl/aktualnosci/fotowoltaika-dofinansowanie2023-lista-aktualnych-dotacji/, accessed 25.07.2023

[5] Kacejko P., Adamek S., Wancerz M., Jędrychowski R., Ocena możliwości opanowania podskoków napięcia w sieci nn o dużym nasyceniu mikroinstalacjami fotowoltaicznymi, Wiadomości elektrotechniczne, 9 (2017).

[6] Topolski Ł., Wojciech Schab W., Andrzej Firlit A., Krzysztof Piątek K., Analiza wpływu generacji rozproszonej na wybrane parametry jakości en. elektrycznej w sieci nn na terenie klastra Wirtualna Zielona Elektrownia Ochotnica, Przegląd Elektrotechniczny, 3 (2020), 17-20.

[7] Mateusz Dutka M., Krzysztof Piątek K., Tomasz Siostrzonek T., Szymon Barczentewicz Sz., Bogusław Świątek B., Symulacja wpływu odnawialnych źródeł energii na zmienność wartości skutecznej napięcia sieci dystrybucyjnej, Przegląd elektrotechniczny 5 (2020), 26-29.

[8]https://enerad.pl/aktualnosci/za-wysokie-napiecie-w-sieci-afotowoltaika-co-trzeba-wiedziec/, accessed 25.07.2023

[9]https://muratordom.pl/instalacje/fotowoltaika/dlaczegofotowoltaika-nie-dziala-prosumenci-zglaszaja-reklamacje-dooperatorow-jak-rozwiazac-problem-z-pv-aa-9R19-mMkaf1fJ.html accessed 25.07.2023

[10] Rafał K., Bielecki S., Skoczkowski T., Dynamiczna regulacja napięcia w sieci rozdzielczej, Przegląd elektrotechniczny, 5 (2016), 49-53 z wykorzystaniem falowników generacji rozproszonej

[11] Cieślik S. Nowa rola stacji elektroenergetycznych w sieciach

dystrybucyjnych niskiego napięcia. Elektroenergetyka Nr 242- 243, 2019, 3-15.

[12]https://biznes.interia.pl/gospodarka/news-nadprodukcja-energiiz-oze-operator-odlaczyl-od-sieci-czesc-,nId,6736549 accessed 25.07.2023

[13]https://energia.rp.pl/oze/art38374801-stan-zagrozenia-dostawpradu-za-duzo-energii-ze-slonca accessed 25.07.2023

[14] Olczak P., Przemysław Jaśko P., Kryzia D., Matuszewska D., Fyk M.I., Artur Dyczko A., Analyses of duck curve phenomena potential in Polish PV prosumer households’ installations, Energy reports, 7 (2021), 4609-4622.

[15] Act of January 27, 2022, amending the Act on Renewable Energy Sources and the Act amending the Act on Renewable Energy Sources and certain other acts, Dz.U. 2022 poz. 467

[16] Act of February 20, 2015, on renewable energy sources, Dz.U. 2015 poz. 478

[17] https://re.jrc.ec.europa.eu/pvg_tools/en/ stan na dzień 25.07.2023

[18] https://www.gov.pl/web/nfosigw/nabor-iv-wnioskow-2023-2024 stan na dzień 25.07.2023

[19] https://www.gov.pl/web/nfosigw/przemysl-energochlonny—ozestan na dzień 25.07.2023

[20]https://www.bosbank.pl/kredyt-ekologicznyfenggclid=Cj0KCQjw2eilBhCCARIsAG0Pf8s5CDDw4A1LLCA0sXKlgVEiBb0dYlcruDJpbsb8VNqrA6iBLLEHl8aAlvGEALw_wcB&gclsrc=aw.ds

[21] http://www.pse.pl stan na dzień 25.07.2023

[22] https://www.gov.pl/web/klimat/rusza-piata-edycja-programumoj-prad stan na dzień 25.07.2023

Authors: dr inż. Wiktoria Grycan, Politechnika Wrocławska, Katedra Energoelektryki, Wybrzeże Wyspiańskiego 27, 50-370 Wrocław, E-mail: wiktoria.grycan@pwr.edu.pl;

Source & Publisher Item Identifier: PRZEGLĄD ELEKTROTECHNICZNY, ISSN 0033-2097, R. 100 NR 2/2024. doi:10.15199/48.2024.02.12