Published by Mohammad Abu Sarhan, Andrzej Bien´, Szymon Barczentewicz, Rana Hassan, AGH University of Science and Technology

Abstract. In Jordan, there are many extensive challenges that the country faces against the national economy growth. This is mainly because Jordan has limited primary energy resources and imports more than 90% of natural gas and crude oil from neighboring countries which negatively affect its economy. However, the geographical location of Jordan is one of the benefits that make the country rich in renewable energy resources particularly solar and wind energy resources. Therefore, to fulfill the high growth of electricity demand in the coming years; Jordan is working on increasing the contribution percentage of renewable energy resources in the total energy mix. In this paper, the status of the electricity supply system and renewable energy resources in Jordan are discussed. Furthermore, the investigation of implementing the prospect scenario of increasing the share of electric generation from renewable energy resources shows that the generated power from solar and wind are significantly enhancing the national economy growth.

Streszczenie. W Jordanii istnieje wyzwan wpływaj ˛ ´ acych na rozwój gospodarczy tego kraju. Jednym z takich wyzwan jest brak pierwotnych ´ ´ zródeł energii, co zmusza kraj do importu 90% energii, tj. ropy i gazu, od krajów osciennych. Geografia Jordanii pozwala jednak na du ´ zy rozwój energetyki ˙ odnawialnej, w szczególnosci energetyki opartej na energii sło ´ nca i wiatru. Wa ´ znym elementem zapewnienia poda ˙ zy na rosn ˛ ˙ acy popyt na energi ˛e jest wi ˛ec rozwój energetyki odnawialnej. W artykule omawiany jest obecny stan energetyki Jordanii oraz omawiany jest rozwój energetyki odnawialnej w miksie energetycznym tego kraju.(Przegl ˛ad systemu energetycznego oraz sektor energii odnawialnej w Jordanie)

Keywords: Electric Energy, Renewable Energy, Solar Energy, Wind Energy

Słowa kluczowe: Energia elektryczna, odnawialne ´zródła energii, energia słoneczna, energia wiatrowa

1. Introduction

Globally, the demand of electric energy is growing rapidly year by year. In addition, the price of oil and pollution, that caused by the burning process of fossil fuels, are increased clearly. The depletion of oil source supply is possible. Hence, the study of using other alternatives like using renewable energy resources such as solar and wind energy to generate the electric power gets more attention.

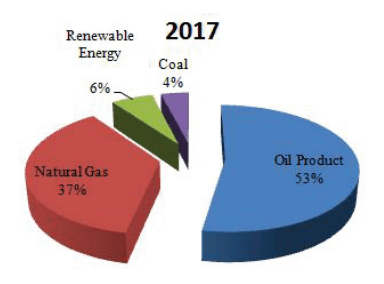

Jordan is a country that located on the northern Arabian Peninsula and covers an area of 89,342 km2. Jordan has a cool weather in winter and a semi-dry in summer. One of the challenges that the energy sector faces in Jordan is the rapid growth of energy demand, and the other is the country has limited local resources to fulfill the required demand [1]. Around 94% of Jordans total primary energy supply is covered by natural gas and crude oil/petroleum products while less than 6% is represented by renewable energy in 2017 as shown in (Fig. 1). Because Jordan has a shortage in local natural gas and traditional crude oil resources, Jordan imports more than 90% of that resources form borders countries [2]. Therefore, the countrys national economy has significantly affected by importing crude oil and natural gas.

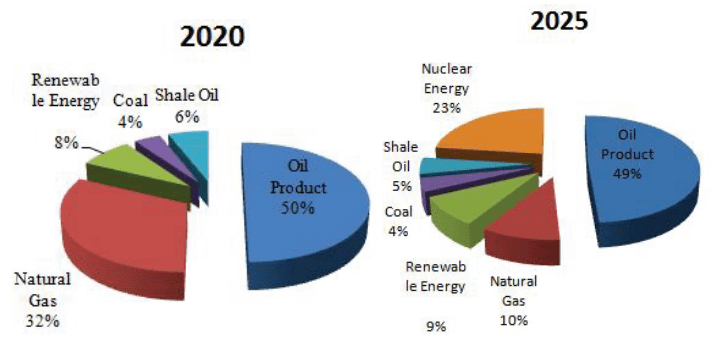

Jordan witness high growth of energy demand. For instance, in (2008-2020) the growth of electricity demand is 7.4% which shows that the additional generated capacity needed up to 2020 is 4000 MW, an average of 300 MW per year. While, the growth of primary energy demand is 5.5% for the same period, hence the expected demand for primary energy amount is 15 million tons of oil equivalent in 2020 compared to 7.5 million tons of oil equivalent in 2008 [3]. On the other side, Jordan’s population had observed a rapid increase in the recent years especially due to the conflicts that neighboring countries suffer and leaded to a high rate of refugee waves immigrate to the country [4]. These challenges increase the added pressure on the electricity system in Jordan in the upcoming years. To fulfill the high growth of electricity demand in near future, the government of Jordan has launched some strategies related to energy to improve the involvement of renewable energy resources to the national power source supply. By 2020 and 2025, the contribution of renewable energy resources to the total energy mix can reach to 8and 9% respectively, including various wind and solar projects specifically 300-600 MW of solar energy projects and 600-1000 MW of wind energy projects [2] as presented in (Fig. 2). In addition, the government has established a legal plan to minimize the energy consumption using energy efficiency measures by allocating a special budget that supports renewable energy and energy efficiency projects.

In this paper, the development of electricity supply system in Jordan is discussed. Furthermore, the possible scenario of implementing renewable energy resources including solar energy and wind energy resources to the national electricity system is investigated. The analysis of this scenario is carried out based on economical, social and environmental aspects.

2. Energy Sector in Jordan

The energy sector in Jordan is under umbrella of both Ministry of Energy and Mineral Resources (MEMR) and Energy and Mineral Regulatory Commission (EMRC). The main function of this ministry which was established in 1984 is to develop general policies, to monitors its implementation to achieve the security of a sustainable energy supply, to fix tariffs, and to legalize all activates with an influence on energy. Furthermore, MEMR has some responsibilities to define new strategies and projects to promote renewable energy resources such as solar and wind energy resources [5]. While, the main role of EMRC is to grant licenses and permits to companies working in the energy sector, monitor and verify the compliance of licenses, determine the electric tariff, and to participate in setting slandered specification and technical rules related the energy sector facilities and equipments [6].

2.1. Electricity Sector in Jordan

The electricity system in Jordan includes four major divisions: power supply generation, power supply transmission, power supply distribution, and renewable energy resources. The four majors divisions which are shown in (Fig. 3) are briefly clarified below:

2.1.1. Electricity Generation Sector

The generation sector is the sector who is involved in generating the electricity from power plants to be provided to the transmission girds. The responsible companies who are in charge of this sector are as below:

• Central Electricity Generation Company (CEGCO)

CEGCO has been privatized in 2007, 60% of government shares have been sold to Dubai Capital Company (51%) and Social Security Institution (9%). The generation capacity owned by CEGCO is around 1555 MW which covers a 49% of total installed capacity in Jordan. The power plants that are owned and operated by CEGCO are distributed in different location in Jordan. These power plants are: Aqaba Thermal Power Station, Al Rihab Gas Station, and Risha Gas Power Plant [7].

• Amman East Power Company (AES Jordan)

AES Jordan is located east of Amman with a 400 MW capacity produced by both dual fuel natural gas and oil fired. AES Jordan covers almost 8% of the electricity demand in Jordan. This combined cycle power plant was built and operated as a public private project (IPP1). As well as, it owns and operates Levant Power Plant (IPP4) which was built mainly to be operated during the peaking time. Levant Power Plant is a tri-fuel engine technology that located on the same location of AES Jordan [8].

• Qatranah Power Company (QPCO)

QPCO is a 373 MW power plant that is located in Al Qatranah about 90 km south of Amman. This power plant was constructed by a consortium of Korea Electric Power Corporation (80%) and Xenel Industries Ltd (20%) in 2008 as Al Qatrana IPP. The output produced power of this plant is totally sold to Jordan National Electric Power Company (NEPCO) under the obligations of Jordanian Government in term of financial issues [9]

• Samra Electricity Power Company (SEPCO)

The total capacity of SEPCO is 1175 MW which approximately covers 40% of Jordan’s load demand. The electric power is generated using various technologies of conventional energy resources. SEPCO is totally a state owned company [6].

• Amman Asia Electric Power Company (AAEPC)

AAEPC is a power plant with 573 MW installed capacity and located in Al Manakher around 30 km from Amman. The plant was built, owned, and operated using natural gas and heavy fuel oil by a consortium of Korea Electric Power Corporation (60%), Mitsubishi Corporation (35%), and Wartsila Development & Financial Services (5%). The plant was installed in 2015 to achieve the goal of energy self-sufficiency by reducing the import of Egyptian gas [10].

• Attarat Power Company (APCO)

Attarat Power Plant is the first project that produces electricity using the direct burning of oil shale with a capacity of 460 MW that covers 15% of the load demand in Jordan in 2020. The construction work of this project has started in 2017 by a partnership between Guangdong Yudean Group (45%), YTL POWER (45%), and Eesti Energia (10%) [11].

• Jordan Biogas Company

The main objective of this project which is located in Ruseifa near to the capital city Amman is to reduce the problems associated to environmental pollution. The plant was built to convert around 27 million cubic meters of biogas into 48 GW of electric capacity annually [12].

• Zarqa Power Company (Acwa)

This plant was built to substitutes Hussein Thermal Power Station that is located in the industrial zone of Zarqa city and was deactivated in 2015. The generated power capacity of this plant is 485 MW using combined cycle gas fired leading to minimize the emissions and fuel consumption per MWh of the generated power. The main goal of this project is to achieve the strategy of nation energy 2025 by increasing the local power generation by 40% by 2020 [13].

2.1.2. Electricity Transmission Sector

The transmission sector in Jordan is 100% owned and operated only by National Power Company (NEPCO). The main role of this company includes but not limited to different tasks such as transmission lines construction and maintenance, development and planning of transmission stations, and buying power energy from various suppliers to sell it to distribution companies. The transmission network and the National Control Center are fully owned by NEPCO which consists of 10023 MVA major substations and 132 kV and above high voltage transmission lines with total length of 4121 km-circuit [7].

2.1.3. Electricity Distribution Sector

The main role of distribution sector in Jordan is to distribute the power source that needed by end consumers including industrial, commercial, and residential end consumers. The responsible companies of this sector are presented below:

• Jordan Electric Power Company (JEPCO)

JEPCO is responsible for distributing about 66% of the total consumed power in Jordan. The electric power is distributed by JEPCO to locations that extend from Wadi Al-Dleil in the north to Theiban in the south and from Mowager in the east to Al-aghwar in the west [14].

• Irbid District Distribution Company (IDECO)

IDECO is responsible for distributing the electric power to 25% of the geographical area in Jordan. The electric power is distributed by IDECO covering a total area of 23,000 km2 in the north of the country including Mafraq, Jerash, Ajloun, and Irbid [15].

• Electricity Distribution Company (EDCO)

EDCO is responsible for distributing the electric power to various geographic locations in Jordan particularly the southern districts of the country. The areas that get the power source by EDCO in Jordan are specifically Zarqa, Tafilah, Karak, Maan, and Aqaba [16].

2.1.4. Renewable Energy Sector

The companies are responsible for generating electric power using renewable energy resources either solar energy or wind energy in Jordan are 29 companies in total. Specifically, there are 7 wind energy companies and 22 solar energy companies are involved in this sector in Jordan [3] According to the main structure of the electricity sector in Jordan which was presented above, the electricity demand in Jordan for a certain periods is discussed below.

2.1.5. Electricity Demand for the period 2015-2025

The electricity demand has been increased greatly year by year in Jordan. For instance, the annual growth rate for the peak load between 2015 and 2025 is approximately 5.5% and the annual growth rate for the generated electric power for the same period is around 5.3% [17]. Table 1 shows the increasing amount for both peak load and generated electric power between 2015 and 2025.

Table 1. Electricity demand for the period 2015-2025

3. Renewable Energy Resources in Jordan

The market of renewable energy resources is recently growing in Jordan. Increasing the contribution of renewable energy to the future energy mix has become a key policy priority in Jordan. This is because Jordan aims to diversify its economy against a backdrop of increasing local energy demand.

The geographical location of Jordan makes the country has a clear richness in renewable energy resources especially solar and wind energy resources. Jordan is located within the region that is known as a region of the Sun Belt which is located between latitudes 25 north and 25 south; therefore the area is exposed to a high average direct solar radiation during 316 days per year at an average of 8 hours per day. Regarding wind energy resource, Many areas in Jordan are characterized by wind speeds ranging from 7-8.5 m/s which is a suitable speed to construct wind plants that generate electricity among the country.

3.1. Solar Energy Resource

The most essential parameter for calculating the energy yield and assessing the performance of photovoltaic energy technologies is based on the average daily/yearly sum of global horizontal irradiation (GHI). Based on the average daily/yearly sum of global horizontal irradiation, Jordan is classified into five special areas with different amount of exposed solar irradiation as shown in Table. 2 [18].

Table 2. Average daily/yearly sum of global horizontal irradiation

In Jordan, the PV system is implemented as kW rating systems which are installed on roofs or as MW rating systems which are installed as power plants. For low kW rating systems, the electricity amount which can potentially obtained over an average year can be evaluated for all regions based on the assumption that the net efficiency for PV modules that used all over the country is 15%. Based on that, the Eastern region has the highest electricity production potential (0.85 – 0.92 TWh/a) compared to other regions and the Western region has the lowest electricity generation potential (0.21 – 0.23 TWh/a) among all regions. The total generated power potential for all regions is (2.69 – 3.25 TWh/a) as presented in Table. 3. Consequently, for MW rating systems, the Eastern region has the highest electricity generation potential (356 – 398 TWh/a) and the Northern region has the lowest electricity generation potential (3 – 4 TWh/a). The total generated power potential for all regions is (465 – 508 TWh/a) as presented in Table. 4.

Table 3. Potential of electricity generated by low kW rating systems

Regarding photovoltaic (PV) systems, the distribution of solar radiation is relatively uniform in Jordan which makes this technology to be proper for electricity generation in Jordan. In addition, in rural and desert areas PV technology is proper for off-grid power production in power plants. The capacity of power production from off-grid PV systems can reach to 1000 kW peak in these areas, where the produced power by PV technology is used for different applications such as houses lighting, water pumping, and other activities. Furthermore, many projects of on-grid PV plants have been constructed among the country with total capacity reach to around 200 MW are located in and near to southern region of the country. About 11 projects have been established in Maan region, the most important of which is Shams Maan Power Generation Project with 52.5 MW total capacity and provide 1% of Jordan electricity current generation [19]. Other project also have been built in different locations such as AlMafraq station (50 MW), Al-Quweira plant project (103 MW), Al-Risha solar power plant (50 MW), and Al-Baynunah solar power plant which is located east of Amman (200 MW).

Table 4. Potential of electricity generated by high MW rating systems

While regarding solar thermal systems, the implementation of concentrated solar power (CSP) by domestic loads has increased in Jordan. Approximately 20% of households are using solar water heaters on their roofs. Furthermore, a round 30% of households get solar water heaters on their roofs by 2020. The first CSP project and solar desalination plant have launched by the government with around 300 MW – 600 MW installed capacity in Aqaba by 2020.

3.2. Wind Energy Resource

In Jordan, the resources of wind energy are plentiful to provide a significant amount of power capacity that covers the country needs if effectively invested. The energy yield calculation and assessment of wind energy technologies depend on an important factor which is the yearly average wind speed of the country. Jordan can be divided into five territories based on the annual average wind speed at 50 m height above the ground [18]. The first territory, which is the most capable place to construct wind farms, has a yearly average speed exceeds 7.5 m/s at 50 m height above the ground. This territory is exactly located in the North ( Al-Ibrahemia and Hofa), and in the South (Fujeij). The second territory has a yearly average wind speed varies between 6.5 to 7.6 m/s at the aforementioned height. The third territory represents around 30% of Jordan and has a wind speed varies between 5.5 to 6.5 m/s. While the fourth territory represents around 45% of Jordan and has a wind speed varies between 4.5 to 5.5 m/s. The last territory has a wind speed varies between 3.5 to 4.5 m/s.

The main use of wind energy in Jordan is for electricity production. There is various wind energy projects have been constructed in Jordan since 1980s in different parts in the country. One of these projects was established as a small grid-connected wind farms with a total capacity of 320 kW in Al-Ibrahimyya region in the northern part of the country. That project was applied by a corporation between the government and the Danish firm Tellus. The other project, which also was established in 80s, was a hybrid solar-wind power plant generates electricity with a capacity of 40 kW of two wind energy converters, 10 kW peak PV systems, 330 kWh of storage batteries, and 65 kW of a backup diesel generator for a remote village in southern Jordan in Jurf El-Darawish. In 1996, a large wind turbine farm was built in northern Jordan in Hofa consisting of five wind turbines of 225 kW each, and with annual total output of 2.5 GWh. Furthermore, various projects have been planned by MEMR to get benefit from the available wind energy specifically Al-Mafraq project (100-150 MW), Maan project (100-150 MW), Wadi-Araba (40-50 MW), Al-Tafelah project (150-200 MW), Al-Fujaij project (70 MW), and Al-Kamshah project (40 MW) [18].

Table 5. Potential of electricity generated by wind mills

In addition, water pumping in remote villages using mechanical and electrical wind power plants is extremely applied in Jordan. Around twenty pumping stations that are used to pump water using mechanical wind mills are made locally. As well as, there is some effort to manufacture the electrical wind turbines particularly the blades and towers locally.

Based on, the yearly generated electricity which can be evaluated for all regions as presented in Table. 5. The total electricity generation potential in Jordan is in a range between 25.5 and 34.3 TW h/a. The highest contribution can be obtained from the region of 5.5 – 6.5 m/s wind velocity with 15.1 – 21.4 TW h/a and the lowest share is obtained in the region with a wind speed between 7.5 and 8.5 m/s with 3.8 – 4.5 TW h/a.

3.3. Other Renewable Energy Resource

There are many prospective to use biogas from solid waste to generate electricity in Jordan. One of the projects that use municipal solid waste (MSW) through biogas technology was built in 2011 with a total capacity of 1 MW. In 2008, the project capacity has been expanded to around 4 MW. Jordan is planning to provide about 40-50 MW waste energy power projects by 2020 [20].

Hydropower resource is considered very limited in Jordan. In the whole country, there is only two hydropower projects have been accomplished. The first project is King Talal Dam which has 7 MW total installed capacity and the annual generated power is around 25 GWh. The other project is executed at Aqaba Power Station by installing 6 MW hydropower turbines to be used in the cooling cycle of the station. Based on several studies, after accomplishing the proposed project of the Red and Dead Seas Canal, extra hydro resources potential of 400-800 MW could be utilized.

There are only some small geothermal projects that are used for the purposes of aquaculture in Jordan. In the Dead Sea rift valley, there are some low and medium geothermal waters have been found by the Jordanian Authority of Natural Resources. The technical and economical potential of using geothermal energy in electricity production have been assessed by various studies. Based on the results, a further deep drilling is needed to judge on the feasibility of these kind of projects.

4. Accomplishments of Energy Sector in Jordan

The energy sector is considered one of the most vital sectors in Jordan due to its great impact on sustainable development. This sector has made great achievements during the last period despite the great challenges it faces from the lack of local sources of energy and its dependence on imports. Jordan imported about 93% of its total energy needs in 2018 compared to 97% in 2014.

Over the past years, a clear policy has been adopted in the energy sector that mainly aims to achieve energy security through diversification of imported energy sources, the development of traditional and renewable local energy sources and their exploitation, the orientation towards sustainable energy and the adoption of a policy of liberalizing energy markets, including oil products market, creating opportunities for the private sector and encouraging it to invest in infrastructure projects for the energy sector, as well as strengthening regional energy linkage projects and maximizing their utilization and improving energy consumption efficiency in all sectors. These are complementary policies whose axes have been implemented within clear and specific work programs and mechanisms.

Table 6. Analysis of economical, social, and environmental variables

4.1. Accomplishment of Electricity Sector

Work continued to strengthen and develop the Jordanian electrical system to cope with electrical loads and to accommodate new conventional and renewable electric power stations. Perhaps one of the most important achievements in this field is the establishment of the Green Corridor project that connects Ma’an with Qatrana electrically, which raised the capacity of transmitting electricity from south to central Jordan from 500 to 1400 megawatts. Work has also been completed on the delivery of electricity to all consumers through the development of distribution networks until the size of the electricity coverage became 99% in all regions of Jordan and the rural electrification program played an important role in this field.

Work also continued to complete Jordan’s electric connection with neighboring countries and to strengthen the existing interconnection lines. As the electric energy exchange with Egypt continued, the Jordanian electrical network has been greatly stabilized. Various memorandums of understanding were signed to link Jordan and Egypt electrically with Gulf countries. There will also be agreement with the Saudi side regarding the electrical tie transmission lines especially after it has been proven effective for both sides.

4.2. Accomplishment of Renewable Energy Sector

A legislative and procedural base has been successfully built by The Ministry of Energy and Mineral Resources in the field of renewable energy, which has led to a noticeable increase in the percentage of renewable energy participation in the energy mix, either through signing a number of energy purchase agreements necessary to establish renewable energy projects according to the direct supply system or through the use of solar energy to cover the consumption of different sectors, which jumped the contribution of renewable energy (solar and wind) in the electric energy mix to more than 1130 megawatts until the year 2020.

This brought about a good economic movement in the local investment sector, as this greatly contributed to creating hundreds of direct and indirect job opportunities, as well as stimulating support work from different sectors, which brought about a developmental movement in the areas where projects are built.

In the same context, the Ministry established in early 2015 the Renewable Energy and Energy Rationalization Fund to work on implementing many projects that include various sectors. The Ministry worked on implementing the Rural Fils project to promote the use of renewable energy and reduce electricity costs in remote areas by providing these areas with solar energy systems to generate electricity with a capacity of 2 kilowatts for each house according to specific conditions set for this purpose.

In parallel, the government approved in April of 2018 the National Plan for Energy Conservation (2018-2020), as the Ministry is working on implementing it in cooperation with partners, which is an important strategic step that includes the implementation of parallel sector plans that are consistent with renewable energy plans and include all ministries, public and private institutions. The plan aims to improve energy efficiency to reach 20% of energy consumed by 2020 while reducing greenhouse gas emissions, in line with the global trend to reduce greenhouse gas emissions.

5. Challenges of Energy Sector in Jordan

Despite the great achievements made by the energy sector during the past years, the sector has faced and still faces many challenges, the most important of which can be summarized as follows:

5.1. Challenges of Electricity Sector

Over the past decades, the electric power sector in Jordan has been characterized by the stability of its technical performance, as the electrical system is one of the best electrical systems in the region and works within the best technical standards, but the sector has started to suffer in the past years from huge financial challenges, the most prominent of which is the financial challenge it faces The National Electric Power Company, after its debt accumulated to exceed 5 billion dinars, due to the Egyptian gas cutoff between 2011- 2015 and the resort to using other types of fuel in light of a significant increase in oil prices at the time and the costs were not reversed on consumers.

5.2. Challenges of Renewable Energy Sector

The Jordanian power grid currently has a limited capacity which only stands at 3200 MW. This limitation causes the grid not to accept a large capacity; it only can receive another extra 500 MW. Therefore, many proposals to construct various renewable energy power projects have been rejected by the government to avoid any overstress on the current grid.

However, in order to boost the renewable energy projects in Jordan the government received some loans and grants from different donors to expand the capacity of the state grid by 1000 MW. In addition, Jordan received around 310 million US dollar grant from Chinas Hanergy firm during the World Economic Forum to expand the grid capacity which will allow more renewable energy project to be built in Jordan.

One of the important issues for Jordan plans is to expand the national electricity grid to increase the number of renewable energy projects and to execute the country strategy.

6. The Proposed Scenario for the Energy Sector until 2030

The analysis which are included in this scenario focus on increasing reliance on local energy sources, reducing greenhouse gas emission, and improving energy efficiency to get the highest possible efficiency percentage, taking into account the energy sector obligations towards the contracts and agreements concluded.

This scenario has been proposed based on various factors, including the economic, social and environmental impacts to achieve the strategy’s objectives of diversifying energy sources and their forms as presented in Table. 6, increasing the contribution of local energy sources specially natural gas, oil shale, and renewable energy to the overall energy mix until 2030 to reach 25%, 8%, and 14% respectively, in addition to increasing energy efficiency in all sectors.

The following things must be considered during the assumptions of this scenario: the electric power source is keeping generated using natural gas and renewable energy resources, continuing work to increase the participation of renewable energy projects in covering Jordan’s electrical energy needs, to increase from 2,400 MW in 2020 to 3,200 MW in 2030 as shown in (Fig. 4), and installing more storage system projects in the electrical network (batteries) to avoid any cut off of power source that is generated from renewable energy projects and to maintain the network stability.

Furthermore, the natural gas sources have to be diversified by taking some points into accounts such as developing the production process in the Risha gas field, and attracting international companies to invest in the field of conventional and unconventional gas exploration in open areas for exploration to cover Jordan needs of natural gas from the currently available resources that cover Jordan needs until 2030. Also, the use of natural gas in various sectors has to be supported to replace oil products in order to reduce emissions; this can be facilitated by constructing the distribution networks of natural gas in major cities.

The crude oil resources also have to be diversified by attracting more international companies to invest in the field of oil shale exploration and its distillation in open areas for exploration.

7. Conclusion

Jordan imports more than 90% of natural gas and traditional crude oil resources from neighboring countries which significantly affect the country national economy growth badly. On the other hand, the growth of energy demand is increasing in the coming years in Jordan due to various economical, social, and environmental reasons which will have a great effect on the electricity system year by year. The government of Jordan has launched several strategies that can help to enhance the implementation of renewable energy projects to support the national power source supply to be capable to fulfill the high growth of electricity demand in the future. As well as, a legal plan has been established by the government to reduce the energy consumption by integrating a proper budget allocation for supporting renewable energy and energy efficient projects among the country. Therefore, it has been noticed that the renewable energy resources market is growing gradually in Jordan. Also, the contribution of renewable energy to the future energy mix is increasing greatly to expand the national economy against any possible risks of increasing local energy demand which will bring a significant positive economic progress in the local investment sector either by declining the percentage of energy import or creating more job opportunities among the region.

REFERENCES

[1] Jordan Energy Situation. Retrieved from: [web page] https://energypedia.info/wiki/Jordan_Energy_Situation/.

[2] Regular Review of Energy Effciency Policies. Retrieved from: [web page] https://energycharter.org/fileadmin/DocumentsMedia/EERR/EERR-Jordan_2010_en.pdf/. [Accessed on 2010].

[3] Jordanian Ministry of Energy and Mineral Resources (MEMR). Retrieved from: [web page] https://www.memr.gov.jo/EN/List/Annual_Reports/ [Accessed on October 2010].

[4] Ahmad Almuhtady, Ahmad Alshwawra, Marwa Alfaouri, Wael

Al-kouz, Ismael Al-hinti: Investigation of the Trends of Electricity Demands in Jordan and Its Susceptibility to the Ambient Air Temperature towards Sustainable Electricity Generation, Energy, Sustainability and Society, pp. 1–18, 2019.

[5] Jordanian Ministry of Energy and Mineral Resources (MEMR). Updated Master Strategy of Energy Sector in Jordan for the Period (2007–2020). Retrieved from: [web page] http://www.nerc.gov.jo/Download/http:english\%20-energy\%20strategy.pdf/.

[6] Energy and Minerals Regulatory Commission (EMRC). Retrieved from: [web page] https://www.emrc.gov.jo/Pages/viewpage?pageID=173/.

[7] National Electricity Power Company (NEPCO). Electrcity Sector Structure. Retrieved from: [web page] https://www.nepco.com.jo/en/electricity_sector_structure_en.aspx/.

[8] Amman East Power Company. Retrieved from: [web page] http://www.aesjordan.com.jo/about-us/.

[9] Qatranah Power Company. Retrieved from: [web page] https://www.xenel.com/al-qatrana-ipp/.

[10] IPP3 Tri-Fuel Power Plant. Retrieved from: [web page] https://www.power-technology.com/projects/ipp3-tri-fuel-power-plant/.

[11] National Electricity Power Company (NEPCO). The

Oil Shale Power Plant. Retrieved from: [web page] https://www.nepco.com.jo/news_page_ar.aspx?news_year=2018&news_ser_no=45#.

[12] Al-azzeh, Ammar, Ad Dankers: Reduction of Methane Emissions and Utilisation of Municipal Waste for Energy in Amman, no. Undp 13180:, pp. 1-65, 2007. 2009.

[13] Zarqa IPP. Retrieved from: [web page] https://acwapower.com/en/projects/zarqa-ipp/

[14] Jordan Electricity Power Company (JEPCO). Retrieved from: [web page] https://www.jepco.com.jo/

[15] Irbid District Electricity Company (IDECO). Retrieved from: [web page] https://www.ideco.com.jo/portal/WebForms/AllArticles.aspx/.

[16] Electricity Distribution Company (EDCO). Retrieved from: [web page] https://www.edco.jo/index.php/en/.

[17] Ministry of Planning and International Cooperation. Retrieved from: [web page] http://inform.gov.jo.

[18] M. Saidan: Sustainable Energy Mix and Policy Framework for Jordan, FriedrichEbert-Stiftung, Amman,Jordan 2011.

[19] Shams Maan Power Generation PSC. Retrieved from: [web page] https://www.shamsmaan.com/page/about-us.

[20] Nada Abdul Rahim: The Energy Sector in Jordan, Brussels Invest and Export Embassy of Belgium,Beirut, Lebanon, 2015.

Authors: Ph.D. Mohammad Abu Sarhan, dr hab. inz. Andrzej Bien, dr in ´ z. Szymon Barczentewicz, Ph.D. Rana Hassan, Department of Power Electronics and Energy Control System, Faculty of Electrical Engineering, Automatics, Computer Science and Biomedical Engineering, AGH University of Science and Technology, aleja Adama Mickiewicza 30, 30-059 Kraków, Poland, email: sarhan@agh.edu.pl

Source & Publisher Item Identifier: PRZEGL ˛ AD ELEKTROTECHNICZNY, ISSN 0033-2097, R. 97 NR 9/2021. doi:10.15199/48.2021.09.25